Insights

22 April 2019

Insights

.jpg)

The banking industry is trending up. With greater accountability and transparency in our institutions, customers are finally coming around to their banks. Confidence is being restored and their trust is growing. For once, the future of banking looks quite bright.

But competition is also on the rise. Customer loyalty can't be taken for granted. Things like security and convenience, once tokens of a great and stable bank, are now merely assumed. New expectations include fewer fees, more personal insight and better online banking features. Bank customers want more, and they are putting a greater burden on financial service providers to step up their game.

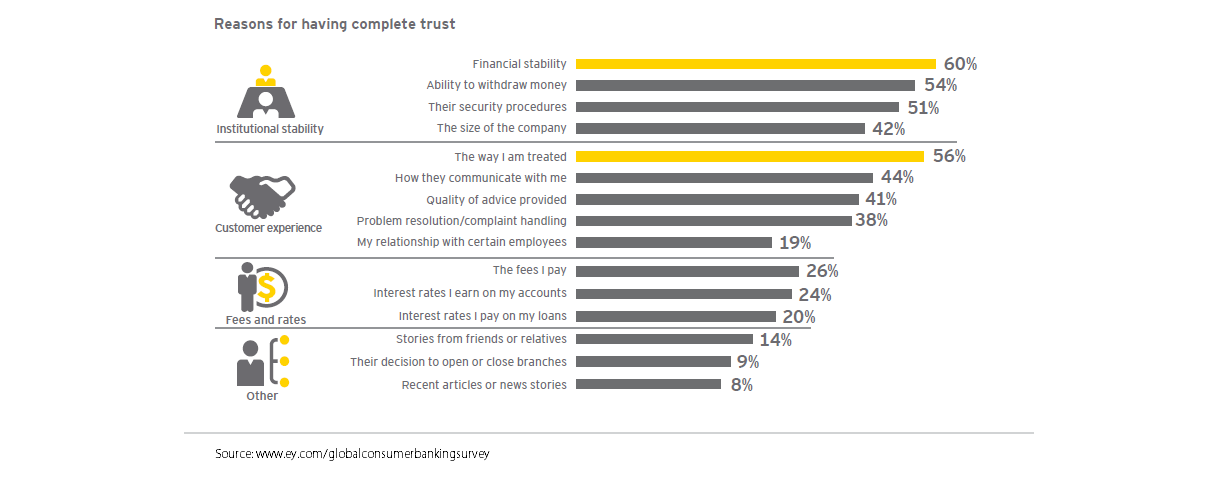

How can financial institutions earn complete trust from their customers? According to Ernst & Young (chart below), it means providing stability as well as an excellent customer experience.

With this in mind, how can banks look to improve their digital strategies as they plan ahead? Three key strategies appear to be of the most immediate concern.

.jpg)

Let's start by thinking about some of your major channels—mobile, online, in-person/branch—and how you can improve customer satisfaction in each one.

Traditionally, branches were where people performed most financial transactions. The staff, branch locations and resource management all played a big part in why a customer might open an account. But times have changed. With costly overhead, human resources, and the shift to mobile self-service, it makes sense to invest in the virtual banking.

Think about how you can deliver some of these branch services via online or mobile channels. Find a way to create easy-to-use digital channels for day-to-day transactions. Streamline ways to sell products through the web. When you've developed a seamless omnichannel banking experience, you'll be able to gain deeper product penetration and expand your portfolio.

Customers who engaged with three or more channels were 90% more likely to come back for another purchase.

Use all the data you have available about your customers to their advantage. Help them customize financial plans and long-term goals. By keeping track of a person's spending history, you can recommend certain products or online banking services based on that information. You can also track when bills are due and when a credit limit or budget is reached. This functionality will not only help your customers draft clearer financial plans, but it will also show your personal investment in their future.

80% of customers are more likely to seek a service from a brand that provides personalized experiences.

Keep in mind, this point is applicable even if your technology is not quite in place. When it comes to financial advice, many people still enjoy speaking to someone at a branch or call center. So it's important to equip your advisors with the right skills and a customer-first attitude; look to demonstrate your expertise and concern while building customer trust in the process.

.jpg)

Digital transformation can have a great impact on revenue within a company. However, digital transformation has an impact on a lot more than that. Employers worldwide that have already implemented a digital transformation strategy are also seeing an increase in productivity among their employees. In fact, productivity is one of the aspects that sees the biggest change as it allows employees to focus on other daily tasks while automated processes are being taken care of in the background. For example, automated workflows make it possible to define any number of simple to complex business processes/workflows, deploy them, and manage them through a portal interface.

Liferay DXP is a great example of how a single platform can eleviate the pressure of daily tasks from employees by automating processes in the background so your team can focus on important items.

This is what makes digital transformation so special. Sure, a business has the potential to reap the financial benefits of instilling new digital tools in the company, but they also empower their employees to reach new heights in productivity they maybe never would reach without automated tools to help them with simple, yet time wasting, daily tasks.

68% of employees say having the digital tools they need at work makes them more productive.