Insights

Digitizing Customers Interactions: Bridging the gap between physical and digital experiences

A difficult situation calls for a bold, new direction

The current outbreak of COVID-19 has drastically changed several aspects of everyday business operations. This comes as no surprise as countries around the world have implemented a stay at home order, restricting perhaps the most fundemental facet of conducting business – unique, physical customer interactions. Customer relationships are a fundemental part of operating a business and without that, customers cannot gain experience what makes a certain company worth coming back to.

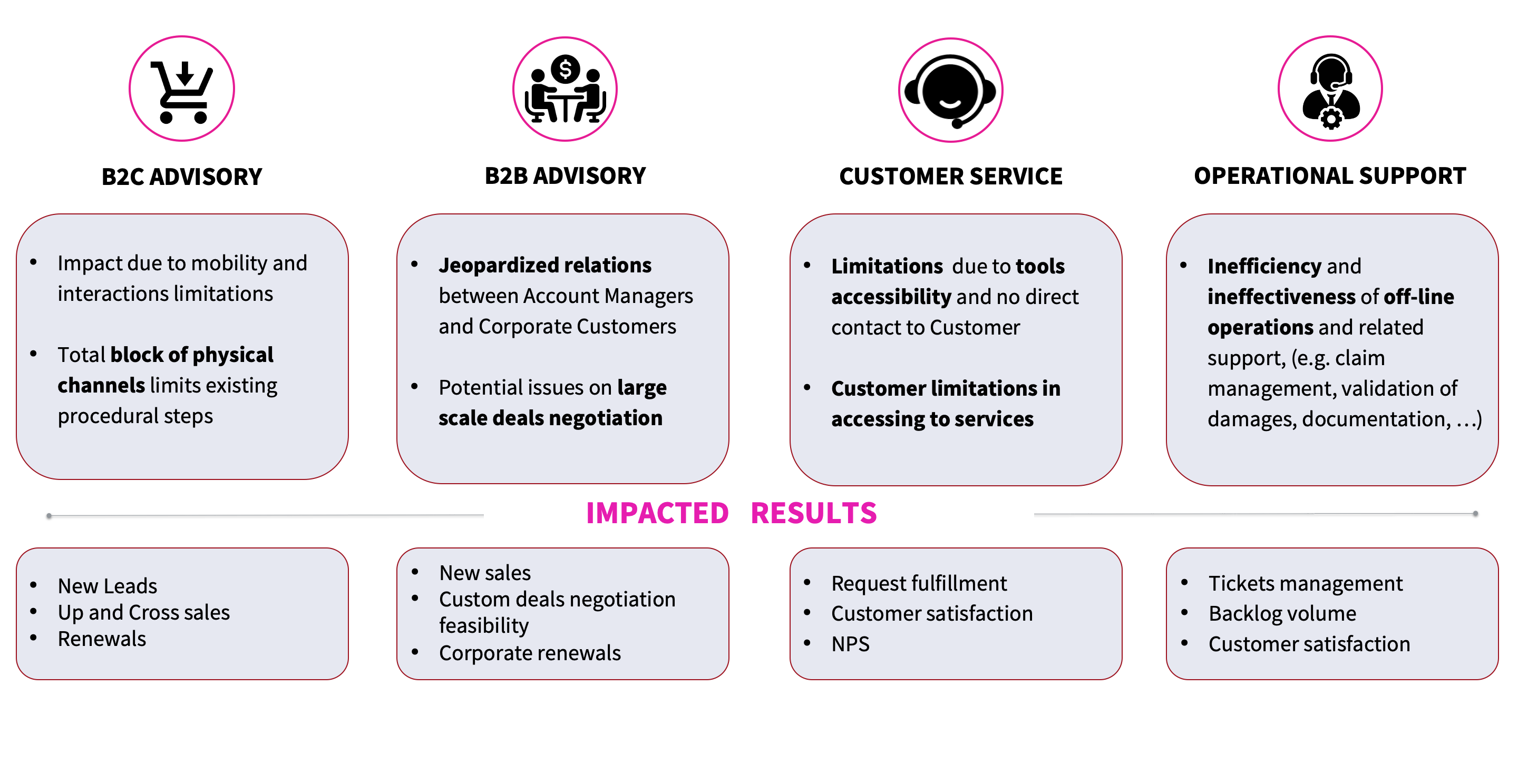

The most impacted areas require human relations

It is no coincidence that the industries most impacted by COVID-19 are the ones that rely on customer interactions, such as banking and insurance. Without the freedom to visit their nearest branch, customers are forced to find other means to communicate with these industries. The effect COVID-19 has had on businesses and customer relationships may not be as clear right away, but over time companies will see the aftermath this pandemic has had on in-person interactions.

The implications of physical limitations

How to digitally replicate the in-person customer experience

Customers now more than ever need access to branches and offices they can no longer visit. Companies now have an obligation to provide that accessibility to their customers to help bridge that gap between physical and digital interactions. Text chatting and chat bots are insufficient for customer support as consumers need a human touch to their interactions.

An element of humanity, even through digital channels, is quintessential to the buying experience. However, the current approach to customer support sees call agents typing in a few lines of text and claim that to be "support". Another common method is to offer a chat bot service. This is possibly the furthest a company can get from adding an element of humanity to customer experience.

This leads into the questions of what kind of features should companies look for to bridge that gap between physical and digital interactions? Here are 3 features that are sure to not only draw customers in to your services, but to also to bridge that physical/digital gap.

Video chat: When put in a difficult situation, video chat is more than just a means for a face-to-face interactions. It is an opportunity for the customer to show the agent what the issue is, such as a live look at the damage being reported using their mobile phone. This will help elimate the need to visit a branch to begin the claim process.

Co-browsing: Customer interactions are more than just being face-to-face. It's about getting the support needed to get the job done. With co-browsing, users and support agents can co-navigate the webpage that is currently being displayed in real-time.

Personal documentation digitalization: Agents can get customer ID, personal documentation and past medical history (which requires a digital security validation) in real time by using the camera of the desktop or mobile phone. This eliminates the need to upload the files and send it through email. The agent captures the image, stores it and close the deal with a digital signature. All of these are actions that are usuall done at a branch.

Screen sharing: In a negotiation or contract clause review, users can show the exact part of contract they are referring to in real time, without quoting a page, or misrepresenting a specific line. This allows both parties to see the same part of a contract, providing an immediate visual understanding as one would have during a physical interaction.

Form sharing: Increase the probability of achieving business goals by assisting visitors fill out forms. Your agent can see in real time what your visitors are entering in webforms, and are able to help them modify the content in the right way, without neglecting the user's privacy.

Tinext can help your company bridge the gap.

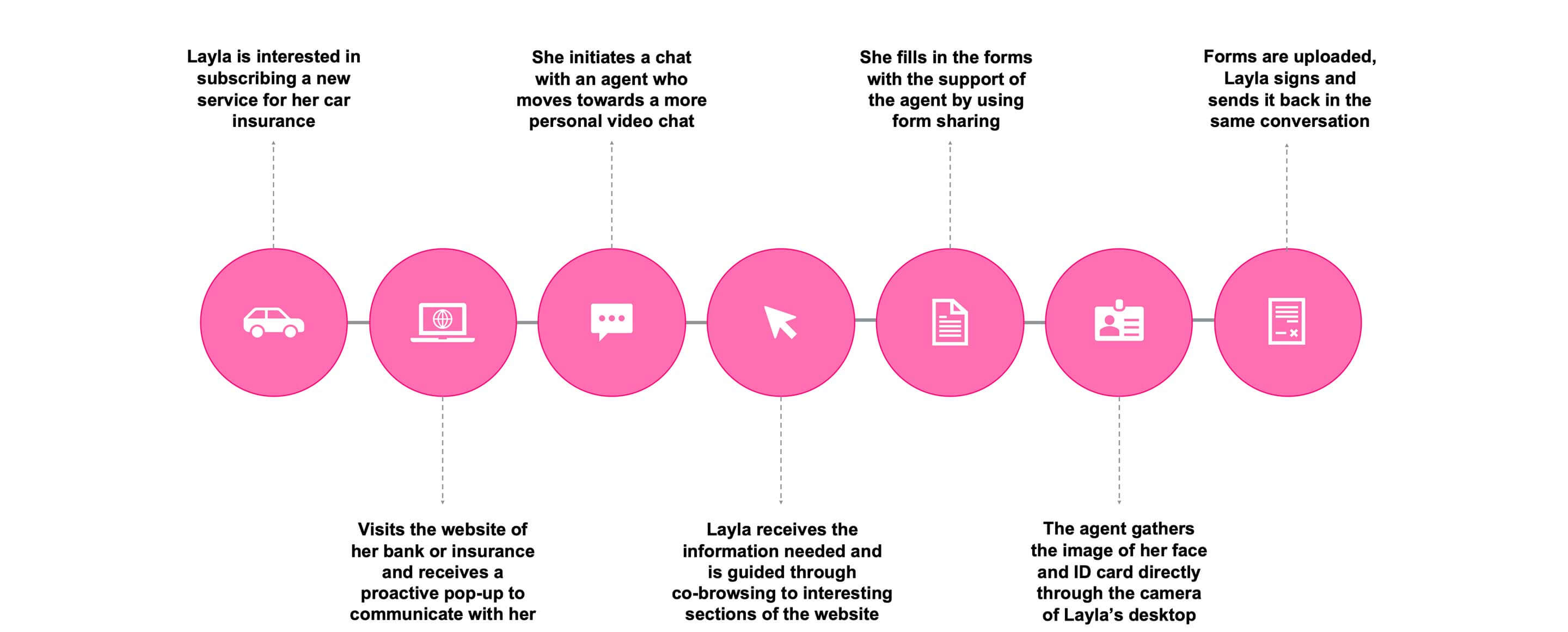

Use Case: Customer Onboarding

While some of these methods of bridging the gap may seem disconnected from each other, the reality is that they are all part of one smooth customer experience. Let's take a look at one way this can be done when onboarding a customer.

Scenario:

In this scenario, Layla is a young professional who is a week away from going on a road trip. She decides to improve her insurance before her drive ahead so she goes to her insurance company's website to see what packages they have to offer. While on the website, Layla is proactively contacted through the company's website. Below is a typical journey any customer, whether in banking or in insurance, can enjoy from the comfort of their home.

Within 7 days, Layla will receive her new car coverage safely from the comfort of her home.

The future of personal customer experience is in your hands

Maintaining the personal and intimate customer experience is as important as it has ever been. Customers need to know that they can still get the same service they have become accustomed to without facing any inconveniences. It is now in a company's hands to give their customers that experience through tools that go beyond text chat and chat bots. With features such as video chat, co-browsing, screen sharing, and form filling, customers can now get the in-person experience from the comfort and safety of their own home. Let us help you move all your customer interactions online and manage them through website, mobile and app, all covered by a one unique solution.